Weighted average anti-dilution is a widely used mechanism designed to balance investor protections with fairness to founders during a down-round. By factoring in the size and price of new share issuances relative to existing capital, this approach adjusts investors’ positions in a more equitable way compared to full ratchet protections.

Below we outline the key formulae behind weighted average anti-dilution. Whether applied via bonus issues or conversion adjustments, these calculations ensure clarity in maintaining economic balance across all stakeholders.

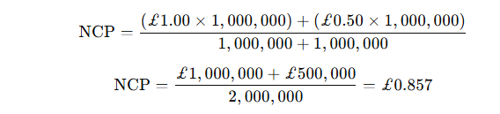

Series A investors purchased 1,000,000 shares at £1.00 per share.

The company issues 1,000,000 new shares at £0.50 per share.

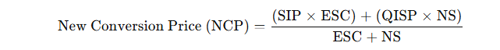

Using the broad-based weighted average formula:

Where:

In this case:

The conversion price is adjusted to £0.857, increasing the number of ordinary shares the investor receives upon conversion.

In a similar scenario, a bonus issue would adjust the investor’s position as follows:

Using the broad-based weighted average formula:

Where:

Using the broad-based weighted average formula:

Substituting values:

Using the formula:

Substitute:

The Series A investors will receive an additional 167,000 shares to preserve their economic position relative to the new valuation and, as a result hold 1,167,000 shares following the bonus issue.

Find out more about anti-dilution protections in this article from our 'Anatomy of a term sheet' series.

Our 'Anatomy of a term sheet' series breaks down each critical section of a venture capital term sheet, offering technical insights and practical real-world examples to help founders with their fundraising journey.

Our aim is to demystify term sheets and empower founders and their advisors to navigate negotiations with clarity and confidence.

Anatomy of a Term Sheet Overview Discover our work in venture & growth capital

Chris Dyson

Partner and Head of Technology Sector

+44 (0)117 321 8054 c.dyson@ashfords.co.uk View more

Rory Suggett

Partner and Head of Corporate

+44 (0)117 321 8067 +44 (0)7912 270526 r.suggett@ashfords.co.uk View more

Jocelyn Ormond

Partner and Head of the Healthcare & Life Sciences Sector

+44 (0)7872677082 j.ormond@ashfords.co.uk View more

Andrew Betteridge

Partner & Head of the Commercial Services Division

+44 (0)117 321 8063 +44 (0)7843 265362 a.betteridge@ashfords.co.uk View more