The recent case of Manolete Partners plc v Hayward & Barrett Holdings Limited and others (Re Blackwater Plant Limited [2021] EWHC 1481 (Ch) has caused some consternation in the insolvency community as it has potentially significant consequences for how certain claims can be brought and case managed together, whether those claims have been assigned to a third party (as here) or are pursued by the office holder directly. We consider how this plays out in practice.

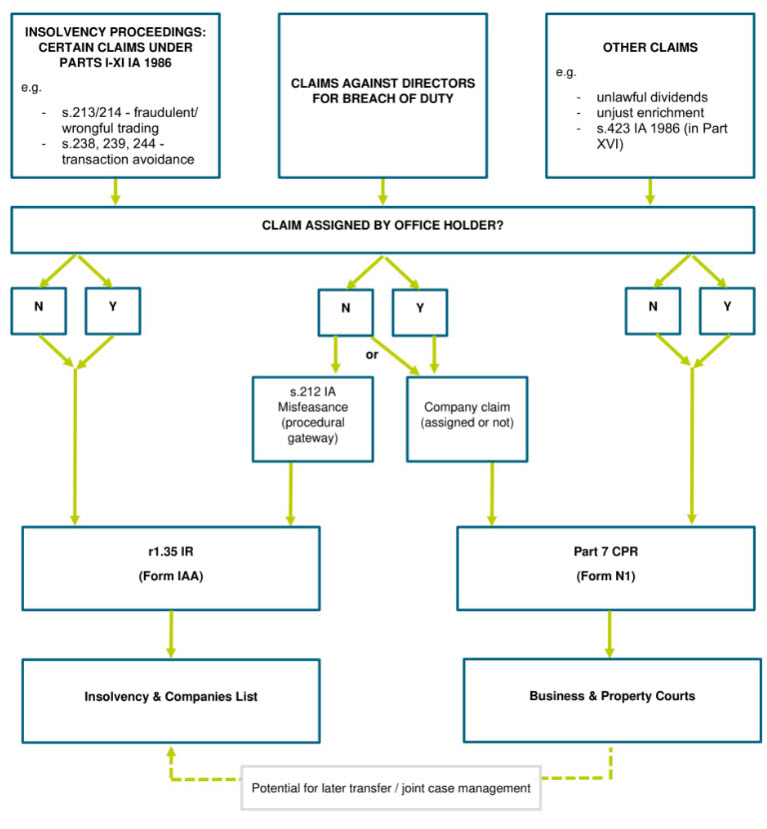

In his judgment, Chief ICC Judge Briggs found that the existing statutory framework restricts the claims that can be brought by way of Form IAA Insolvency Application strictly to ‘insolvency proceedings’ within the meaning of r1.35 of the Insolvency (England & Wales) Rules 2016, which are essentially claims under Parts I to XI of the Insolvency Act 1986 (with limited exceptions). Any other claims – which anecdotally there has been widespread practice of including ancillary to the insolvency proceedings under the same application as ‘hybrid claims’ – must (as the law stands) be proceeded with by way of Part 7 claim.

Further, the Blackwater case concerns a series of claims which had been assigned to Manolete, a popular insolvency litigation funder, causing the judge to consider also how assignment affects the procedural pathway for certain claims. In the case of claims against directors for breaches of duty, although underlying company claims against its directors can be assigned, it is not possible to assign an office holder’s s.212 misfeasance claim of itself - that is effectively a convenient procedural gateway for office holders to pursue a company’s claims by Insolvency Application, and without the same security for costs concerns. Pursuing the company’s claims (either acting by the office holder, or in the capacity as an assignee) will not amount to an insolvency proceeding and must be commenced by Part 7 claim.

The following decision tree sets out where claims should be brought:

Insolvency proceedings are subject to a relatively nominal fee structure. By contrast, the issue fee for a Part 7 claim form seeking recovery of at least £150,000 is £10,000. The increased cost will prove more of an impediment to claims which would otherwise have been funded from an insolvent estate with limited liquid assets, and may promote the popularity of assigning claims to specialist funders.

Part 7 claims are listed in the general Business list, whereas Insolvency Applications are listed before a specialist judge in the Insolvency & Companies Court (a sub list), which may give rise to differing approaches to case management on a hybrid claim that would otherwise have been run together, with a potentially divergent timetable and increased costs. After issuing the claims there is potential for proceedings to be transferred to the same list but that will be at the court’s discretion.

There is a carve out for Insolvency Applications from the latest Practice Direction under CPR 57AC that otherwise imposes onerous obligations on the preparation and presentation of witness statements filed in the Business & Property Courts from 6 April 2021. The approach to statements of case and evidence between Part 7 claims and Insolvency Applications could be very different – which again adds to cost for both applicant/claimant and respondent/defendant.

Some non-insolvency proceedings claims may be abandoned for convenience to avoid running a linked Part 7 claim parallel – for example pursuing a director for misfeasance in relation to an unlawful dividend, and not advancing the unlawful dividend claim substantively. However, in doing so applicants will be narrowing their range of claims and arguments, as well as potentially other sources of recovery if there would have been other respondents (e.g. non-director shareholders that could have been pursued).

Chief ICC Judge Briggs made clear that although he found arguments that issuing and case managing hybrid claims together to be compelling (which would promote a convenient, sensible and economical use of course resource, in accordance with the overriding objective), he reached his conclusions with regret as he was constrained by the current statutory framework.

The Blackwater decision was timely in that it coincided with the Insolvency Service’s planned review of the Insolvency Rules, with its consultation having closed 30 June 2021. It remains to be seen whether stakeholder responses will cause the Insolvency Service to adjust the rules to allow hybrid claims to be pursued more readily. In the meantime, practitioners will need to be alive to the peculiarities of the current framework.

For further information on this article, please contact our Restructuring & Insolvency team.

We produce a range of insights and publications to help keep our clients up-to-date with legal and sector developments.

Sign up