On Thursday 22 October 2020 the Chancellor announced changes to the Job Support Scheme, which is still due to come into force on 1st November.

Under the revised Scheme, staff can now qualify if they work at least 20% of their usual hours (rather than the minimum of 33% of their usual hours previously announced) - this means that staff members working as little as one day a week are eligible for the Scheme.

Employers will now need to pay only 5% of non-worked hours (capped at £125 per month, and NICs and automatic enrolment pension contributions in full), instead of 33%. The government will now contribute 61.75% of non-worked hours, capped at £1,541.75 per month.

The scheme will, as before, be open to all small businesses and larger businesses that can show an impact on revenues.

__________________________________________________________________________________________

On Thursday 24 September 2020, Chancellor of the Exchequer Rishi Sunak announced the new Jobs Support Scheme, which will run for six months from the start of November, once the Covid-19 Job Retention Scheme comes to an end.

Whilst further details are awaited, the Chancellor said that the Jobs Support Scheme:

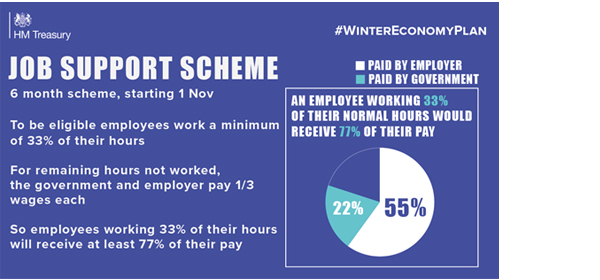

We understand that, under the new Scheme the Government will pay one third, and the employer will pay one third, of the pay which affected employees have lost as a result of reducing their hours, meaning that the employee will receive at least 77% of their normal pay.

We base this view on the following tweet by HM Treasury:

The Chancellor added that employers will not be able to make employees on the Scheme redundant. It’s not clear what restrictions this will place on use of the scheme, so we await further detail.

As with the Covid-19 Job Retention Scheme, the devil will be in the detail. Employers will be keen to know more about a variety of issues, including:

The Chancellor said that further information about the Scheme will be published shortly, and that the details will be worked through with employer organisations and Trade Unions.

Whilst any funding to help preserve jobs is welcome, businesses will hope that clear and detailed rules are published as soon as possible, to help with business planning, and that, unlike with the Covid-19 Job Retention Scheme, those rules are not subject to repeated and confusing repeated amendments.

For more information on this article please contact Charles Pallot or Su Apps.

We produce a range of insights and publications to help keep our clients up-to-date with legal and sector developments.

Sign up