The UK’s new domestic subsidy control regime came into force on 4 January 2023, introducing a new way in which subsidies are determined and regulated.

We will be publishing a series of bitesize briefings which seek to explore the nuances and features of the new regime as set out under the Subsidy Control Act 2022 (“SCA”) and accompanying regulations.

In this article, we will be looking at Special Interest Routes.

The Special Interest Routes are reserved for those subsidies or schemes which have a greater potential to have distortive and/or negative effects on competition, trade or investment either within the UK or internationally. The Government has identified two categories of subsidy/schemes which would meet this criteria which are further defined in The Subsidy Control (Subsidies and Schemes of Interest or Particular Interest) Regulations 2022:

The Government has identified sectors in which a subsidy may have the greater potential to be distortive even at lower monetary values. Consequently, where a subsidy is given to an enterprise engaged in a specific economic activity or input activity in a sensitive sector, and the subsidy confers (directly or indirectly) an economic advantage in relation to that activity, there is a lower monetary threshold for being consider an SSOPI.

The Government will review this list periodically.

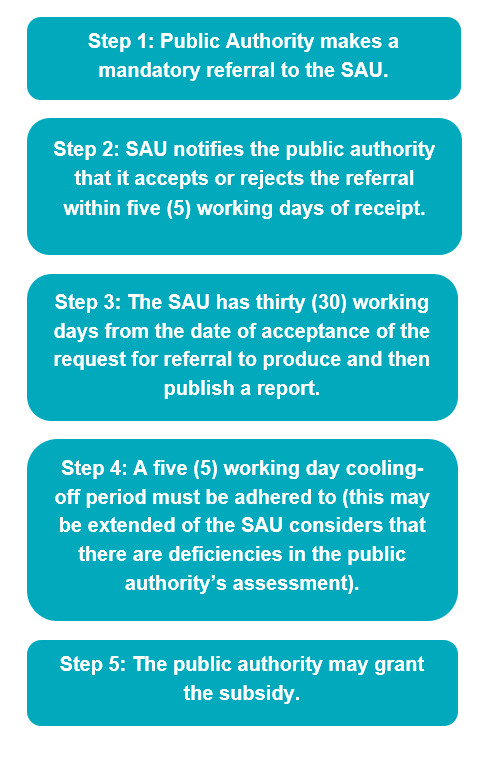

Where a subsidy meets any of the criteria for a SSOPI, the public authority MUST refer its assessment of the subsidy to the Subsidy Advice Unit (SAU) which is part of the Competition and Markets Authority. The subsidy must not be given until the Subsidy Advice Unit publishes its report and a five (5) working day cooling off period has expired.

The process for mandatory referral can be summarised as follows:

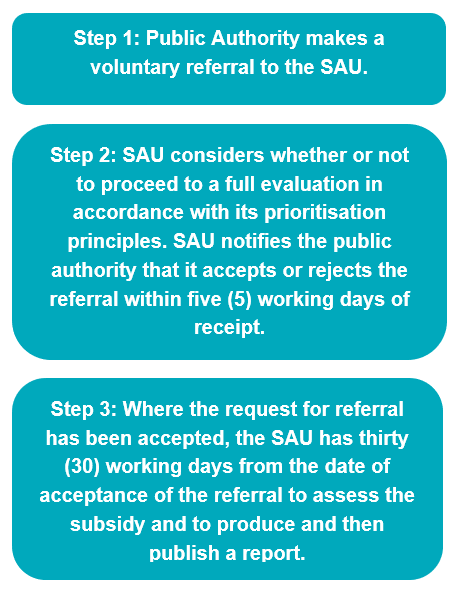

Where a subsidy meets any of the criteria for a SSOI, a public authority MAY refer its assessment of the subsidy to the SAU. Throughout the voluntary referral process, a public authority retains its ability to give the subsidy. It does not have to wait until the SAU has completed its own assessment to grant the subsidy, but the SAU may decide not to publish its report if the public authority decides to do so.

The process for voluntary referral can be summarised as follows:

Where a public authority intends to make a referral (whether mandatory or voluntary), it is encouraged to engage with the SAU in advance to formally submitting the request.

As at the date of this article, there has been one report published by the SAU since the SCA came into force. This was in respect of the Department for Business, Energy & Industrial Strategy’s Contracts for Difference for Renewables Scheme. Click here to view a copy of the report.

A referral has also recently been made by the Department for Energy and Security and Net Zero in respect of its Energy Bills Discount Scheme, which was accepted on 1 March 2023. The report is due to be published by 13 April 2023. Further details can be found here.

The Special Interest Routes offer a new way in which subsidies that have a greater potential to distort competition will be scrutinised and reviewed. However, following referral (whether mandatory or voluntary) to the SAU, each report compiled by the SAU is non-binding and is advisory in nature only. The SAU will not make a decision or recommendation on whether the subsidy or scheme in question should be granted, as this will ultimately be for the public authority considering granting the subsidy to decide. Instead, the report is intended to: (a) evaluate the public authority’s assessment of the subsidy; (b) advise on how the public authority’s assessment of the subsidy could be improved; and (c) advise about how the subsidy may be modified to ensure compliance with Chapters 1 and 2 of the SCA (Section 59 SCA). The publication of a report by the SAU does, however, allow interested parties to evaluate more fully whether to formally challenge the subsidy, thereby increasing transparency in the granting of significant subsidies which is to be welcomed.

Notably, the Special Interest Route is quite different to the notification process under the EU State aid regime, under which certain subsidies are required to be notified and approved by the European Commission prior to being granted. Instead, jurisdiction in respect of the compliance of subsidies is left to the UK courts.

Further information on how the referral processes work are set out in the SAU’s guidance which can be accessed here.

If you have any further or specific queries in relation to the subsidy control regime, or would like any legal support in making a subsidy control assessment or referral (whether mandatory or discretionary) to the SAU, please do get in touch with our Public Sector Team.

We produce a range of insights and publications to help keep our clients up-to-date with legal and sector developments.

Sign up